Following a heated debate on Tuesday night between the Republican nominee and former President Donald J. Trump and Vice President Kamala Harris, stocks for Trump Media & Technology Group (TMTG) experienced a significant decline. The public debate, which many had eagerly anticipated, covered various contentious topics ranging from healthcare to immigration. However, it was the performance and responses given by Trump that seemed to have rattled investors.

Debate Highlights and Key Moments

The debate was marked by several key moments that had pundits and political analysts chattering well into the night. Trump’s responses were seen as particularly defensive when confronted by Harris on topics such as his prior administration’s handling of the COVID-19 pandemic and foreign policy decisions.

Trump’s Stance on Healthcare

Trump reiterated his stance on repealing and replacing the Affordable Care Act, often referred to as Obamacare, but provided little detail on what his replacement would entail. This vagueness may have caused some concern among investors who were looking for clear, concrete plans from the GOP candidate.

Immigration and Border Control

Another focal point of the debate was immigration. Trump stood firmly on his prior policies of stricter border controls and reiterated his desire to complete the border wall. Meanwhile, Harris argued for comprehensive immigration reform, focusing on creating a pathway to citizenship for undocumented individuals currently residing in the United States.

Market Reaction

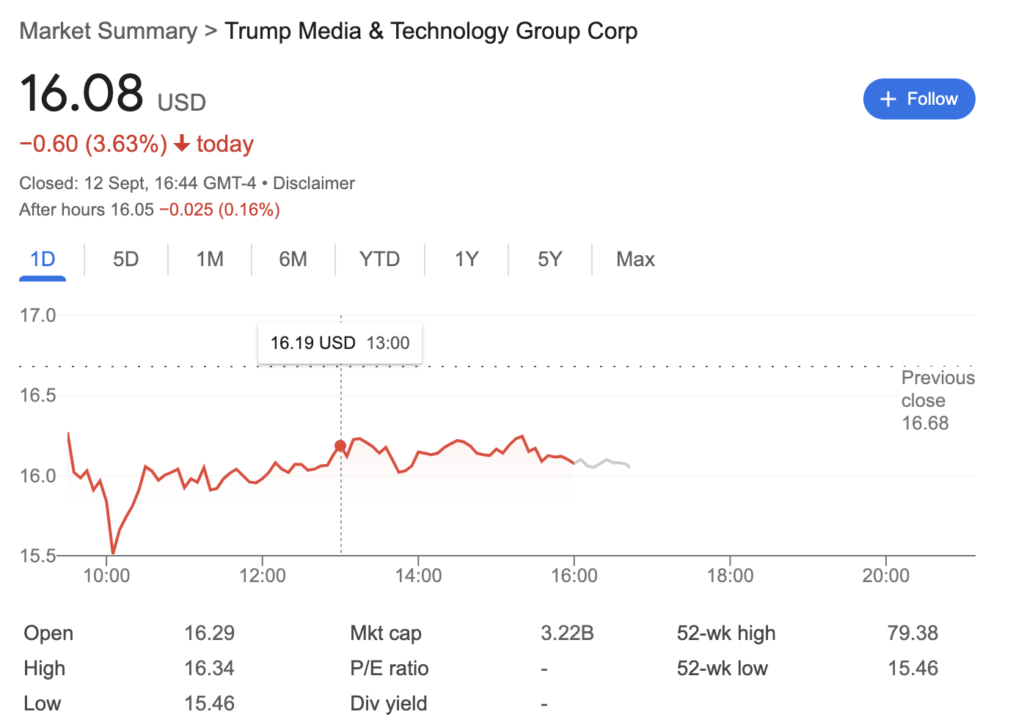

Following the debate, TMTG stock plummeted by approximately 12%, reflecting investor nervousness. Analysts believe that some of this decline is due to Trump’s perceived ambiguity on healthcare policies and his stance on international trade agreements which could impact multiple sectors.

Donald Trump’s tiny social media empire slumped to fresh lows on the stock market, hours after his primetime presidential debate with Kamala Harris.

Shares in Trump Media & Technology Group, owner of the former president’s Truth Social platform, dropped by as much as 17% as of Wednesday morning. They later pulled back, but still closed down 10.5%.

Investor Concerns

- Healthcare: Lack of detailed plans for replacing the Affordable Care Act.

- Trade Policies: Potential implications of Trump’s trade stances on global markets.

- Public Perception: Trump’s controversial replies and defensive demeanor.

Short-Term and Long-Term Impact

While the immediate reaction was negative, some market experts remain hopeful that TMTG stock might recover. The debate, although turbulent, did present Trump with an opportunity to address issues that are important to his base. Investors also believe that if Trump can present more structured plans in future debates, it could bolster confidence in his leadership and, by extension, the stock.

Kamala Harris’s Performance

On the other side of the stage, Kamala Harris delivered a strong performance. She offered a clear vision for the future, highlighting her administration’s commitment to healthcare reforms, climate change initiatives, and social justice. Her composed demeanor and pointed answers resonated well with her supporters and seemed to have put the Republican camp on the defensive.

Key Issues Addressed by Harris

- Healthcare: Enforcing and expanding the Affordable Care Act.

- Climate Change: Introducing policies to combat climate change aggressively.

- Social Justice: Focusing on equality and criminal justice reform.

Market Confidence in Harris

The positive reception of Harris’s performance had a *trickle-down effect* on certain market sectors, especially those aligned with sustainable energy and healthcare. Stocks in these sectors saw a slight uptick as investor confidence was bolstered by Harris’s clear and actionable plans.

Looking Forward

As we inch closer to the election, the market will be closely monitoring the candidates’ performances and their proposed policies. While Trump Media & Technology Group felt an immediate impact post-debate, there is ample time for both candidates to refine their messages and strategies. Future debates will undoubtedly offer further insights into their plans, potentially staving off stock volatility.

A Ray of Optimism

In the grand scheme of things, stock market fluctuations are par for the course during election seasons. Both candidates have the opportunity to appeal to voters and investors alike in the coming weeks. As for TMTG, a rebound could very well be on the horizon if Trump manages to articulate clearer policies and project confidence in future debates.

No matter what, the bipartisan discussions and subsequent market reactions highlight the vibrancy and dynamism of the American political landscape. For investors and voters alike, the coming weeks promise to be both challenging and exciting, filled with opportunities for growth and understanding.